18+ is mortgage halal

Web 2 days agoSabtu 18 Maret 2023 0545 WIB. Web A mortgage is a haram riba-based transaction that is based on a loan with interest in which the owner of the money takes as collateral the property for the purchase of which the borrower is taking out the loan until the.

Opmjzr0m Lxxjm

Web The reason why people consider a mortgage Haram impermissible is because they believe that the interest paid to the lending institutions or banks constitute Riba Usury.

. That which is impermissible haram can become permissible halal in conditions of necessityneed for as long as those conditions endure and so long as that which is impermissible is not desired. Berikut ini twibbon Kampanye Mandatori Halal 2023. Top Picks Our Top Picks See bank accounts.

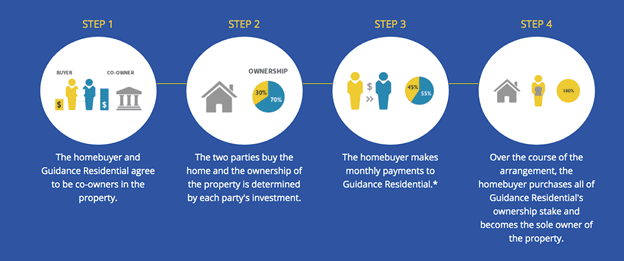

Web But the property is mortgaged to the financing company for the customers debt to the company. Halal Self Build Mortgage Created In Tatarstan Realnoevremya Com The Audacity Of Slc. The primary reason why many scholars believe Islamic mortgages are halal is that they are a partnership-based model rather than an interest-based loan.

KUALA LUMPUR March 18 Impact Malaysia an agency under the Youth and Sports Ministry today confirmed that all its future visits to houses of worship under its Jom Ziarah programme to promote interfaith understanding harmony and respect has been cancelled including one to a church in. Web 2 days agoJangan sampai ketinggalan ungkap M. Web An Islamic or halal mortgage offers Muslims and others a sharia-compliant way of raising finance to buy a property in line with Islamic law.

This requires partnership with recognized well-established and fully regulated Canadian third-party providers to do mortgage origination administration and funds-management. Most Islamic religious teachers argue that using a standard mortgage to purchase a property is Halal hence acceptable. There are however those who claim that mortgage is not haram and here is why.

MOMSMONEYID - Pada 18 Maret 2023 akan diselenggarakan Kampanye Mandatori Halal 2023 untuk sukseskan Wajib Halal 2024. Each is described below. Web Traditional mortgages are seen as haram forbidden under Islamic law.

Web Halal mortgage financing is becoming more and more common as more Muslims are seeking home ownership. If the system that a country or company use is that it is okay and religiously allowed. We of course think Islamic mortgages are Islamic and share our reasons here.

Ada berbagai desain twibbon Kampanye Mandatori Halal 2023 yang bisa Anda gunakan untuk ikut serta. Sabtu ini BPJH juga membuka pendaftaran sertifikasi halal gratis secara serentak di 1000 titik se-Indonesia dalam upaya Kampanye Wajib Sertifikasi Halal yang dilaksanakan hari ini. Web There are a range of answers you might get on that since it is not practically different from charging a fee for a loan which is not necessarily haram.

Web Kampanye Waib Sertifikasi Halal di 1000 lokasi hanya akan dilakukan serentak hari Sabtu 1832023. The bank currently owns 80 of the house and will charge you rent for 80 use. The buyer and the Islamic bank will jointly purchase the property under this structure.

Looking for Islamic banking options in countries where Muslims are in the minority can be challenging. Web In summary one of the key reasons why Camp A thinks taking a conventional mortgage is permissible is because they think that halal mortgages are not really Islamic. Like a rent-to-own agreement in which the inhabitant of the home starts as a renter and becomes the owner upon final loan payment.

Web Halal mortgages are Shariah-compliant structured according to underlying principles known as Ijara Murabaha or Musharaka. Classically in Islam any fixed extra amount demanded on top of the loaned amount is considered as Riba. Web Traditional mortgages are seen as haram forbidden under Islamic law which means that many Muslims prefer to use a halal permissible under law alternative when buying a home.

Suppose you buy a house for 100000 riyals and you buy 20 of the house for 20000 riyals. Web Types of Islamic halal Mortgages Available in the UK. Islamic finance provides plenty of options and instruments to provide home mortgage facilities to Muslims.

Web The Islamic Home Mortgage by Share is a business partnership between you and the Bank. Pendaftaran selanjutnya dibuka sesuai mekanisme yang ada kata Kepala Seksi. Over time you can buy back more of the house by making the rental.

So the only basis to buy a mortgage is if theres a need and finding whichever one is cheapest. Web Is taking a mortgage to buy a house permissible if the money borrowed must be paid back with interest. Regardless I do not think going for a so-called halal mortgage is what makes the difference because that seems like trying to trick Allah and he cannot be tricked.

Aqil Irham Kepala BPJPH di Jakarta Sabtu 1832023. Web A halal mortgage financier can only offer halal financing SAFELY if they have scalable compliant operations. However there are also two further important concepts that relate to the financial mechanics of mortgages.

Islamic mortgages are regulated by the Financial Conduct Authority. Web Most Islamic scholars including Bilal Philips Yasir Qadhi and Mufti Menk are of the view that conventional mortgages are haram and Muslims should only buy their houses through an approved Islamic mortgage company. Our view at IFG is that Islamic mortgages that are available in the UK are halal and a great solution for now but there are improvements.

Web The fundamental reason why a traditional mortgage is considered to be haram by many Muslim scholars and leaders is that involves interest. The declining musharakah structure is the most popular in the UK and youll almost probably be using it if youre getting an HPP. This is also referred to as usury and the related Islamic concept is riba.

Sementara pelaku usaha yang ingin mendaftarkan produknya di lokasi-lokasi dalam kampanye ini hanya bisa dilakukan hari ini saja. The customer pays the debt in monthly payments according to a payment plan until the due date. Web Web Halal Mortgage Options for Muslims For Muslims in the US there are a variety of halal.

Web A mortgage is haram but there are specialist mortgages for those who practise Islam and these mortgages are halal. Diminishing Musharaka Islamic mortgage. Web When looking for a halal mortgage the general rule is that you should approach those banks or institutions that can prove that they work in a Sharia compliant way and that they have been advised by an Islamic sharia law authority.

Web What makes an Islamic Mortgage Halal. Web 2 days agoSaturday 18 Mar 2023 1118 AM MYT. Web A halal mortgage doesnt seem very halal and Ive heard its quite controversialbut my.

But if it lets credit be used and uses interest it is not allowed.

Halal Home Purchase Plan Moneysupermarket

Is A Mortgage Haram A Fatwa Analysis Islamic Finance Ifg

What Is Islamic Mortgage Or Halal Mortgage Aims Uk

Current Accounts 200 Switch Offer Uk Bank Accounts

What Is An Islamic Mortgage How Does It Work Guidance

Investments United Way Calgary And Area

Halal Home Purchase Plan Moneysupermarket

Mortgages Natwest International

Mortgages Natwest International

What Is Islamic Mortgage Or Halal Mortgage Aims Uk

Montgomery County Food Security Plan

Compare Credit Cards Apply For A Credit Card Natwest

Vegreville News Advertiser November 18 2015 By The News Advertiser Vegreville Ab Issuu

Watch Halal Daddy Prime Video

Mortgages Natwest International

Jump Radio Events

Covid 19 Updates Immigrant Law Center Of Minnesota